198

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 02 Mar 2024

198 points (97.6% liked)

InsanePeopleFacebook

2663 readers

3 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

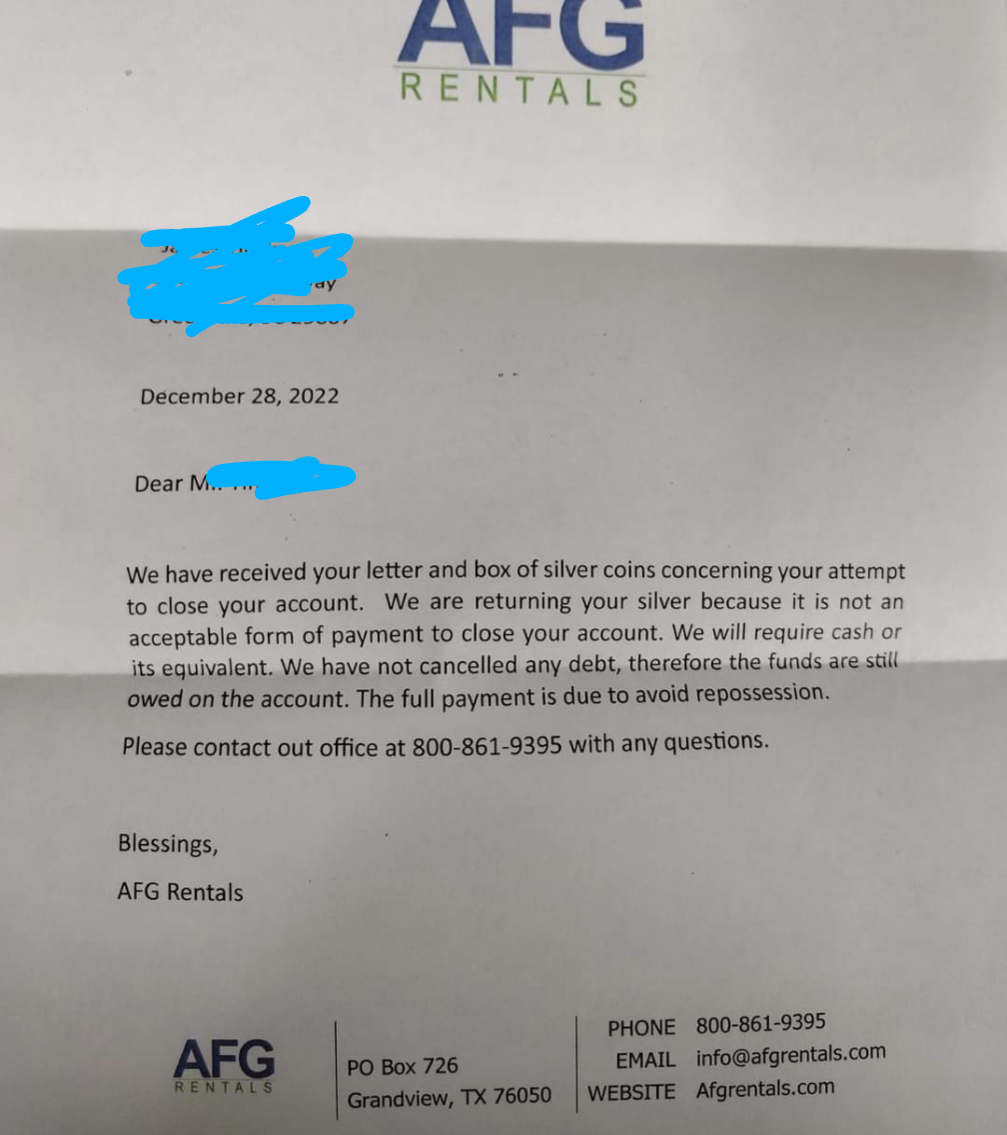

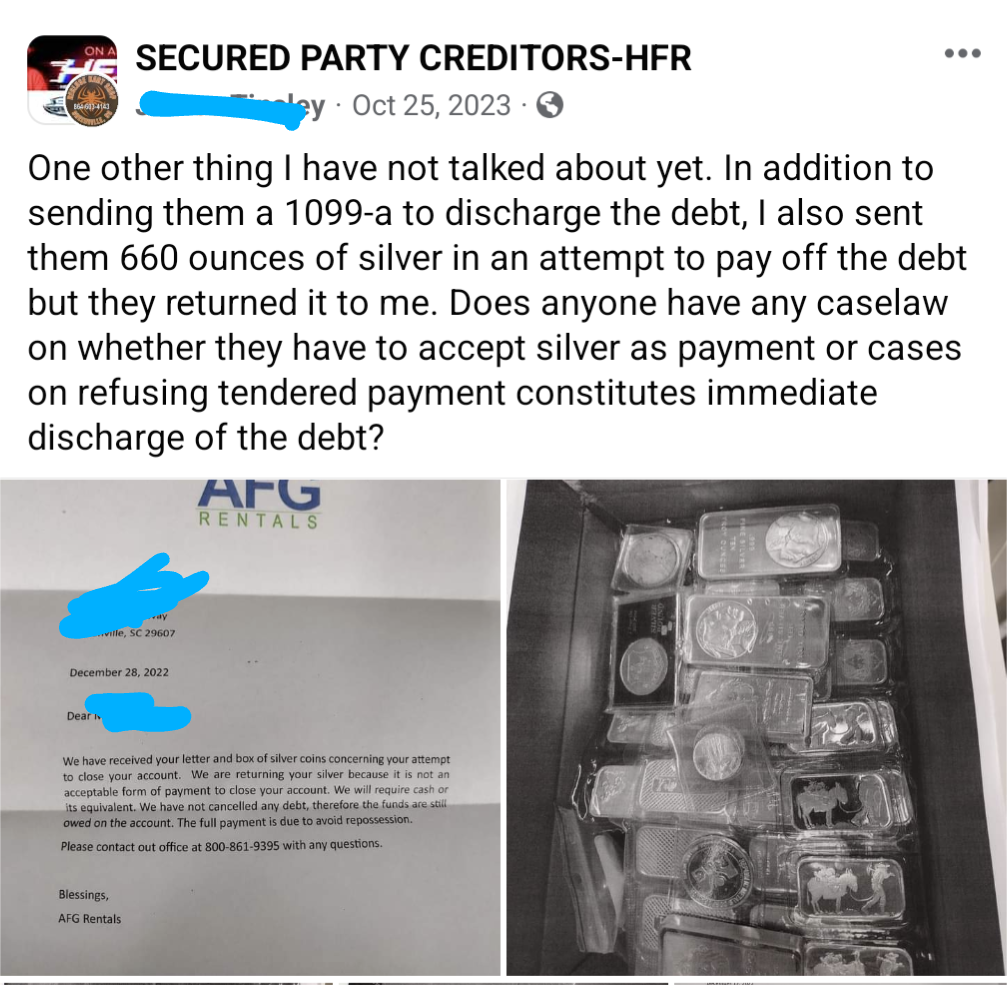

I think I would have applied the silver at face value. "Thanks for your 50 Morgan dollars. We have lowered your balance by $50."

Ingots of silver can be rejected (not legal tender). But you are correct, US coinage is cash and is legal tender. For once, this is a scenario where that term actually applies. The poster owes a debt, and the legal tender must be accepted as payment.

However, since the poster offered the shipment as an offer for "payment in full", such an offer is "all or nothing". They cannot pick out the legal tender coinage and apply it to the debt while rejecting the rest of the shipment. It's not different to how if I owe you a debt of $500, then offer you $50 in cash and a silver ingot as payment in full, you are not entitled to keep the $50 as partial payment while sending the ingot back. You are only able to accept my offer and absolve the debt or reject it and send everything back.

Your second paragraph is correct but the first one is not. An individual is not required to accept legal tender. The government is, but individuals can accept or reject any form of payment.

Not quite. Any seller can reject any form of payment at the point of sale. But, after a contract has been established, private parties are required to accept U.S. currency as a form of payment.

Hence the words printed on paper money: "THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE."

The case Marbury v. Madison (1803) established the power of Congress to declare legal tender. However, it also clarified that this power doesn't compel private entities to accept it for all transactions.

I'm not talking about a transaction like in a grocery store. I'm taking about contracts. Under contract law, a debt paid in US currency is considered fulfillment of the contract.

Individuals are required to accept legal tender. If they refuse payment by legal tender then they get nothing. The debt is absolved by the act of offering (tendering) payment through legal tender. This is why Federal Reserve Notes have "This note is legal tender for all debts, public and private".

Edit: They are required to accept it for debts. They are not required to accept it as payment for goods and services when a debt has not been incurred. For example, a coffee shop isn't required to accept cash and can choose to only accept credit card payments.

We refused cash as a mortgage company.

That is legally impermissible. It's just that nobody bothered to take your employer to court over it. But if someone sends cash, your employer is legally obligated to accept it. If your employer sues someone for non-payment or tries to foreclose and the debtor offers payment in physical cash, it cannot be refused.

We got away with it ≠ it was legal

Section 31 U.S.C. 5103 states that US currency is legal tender for "all debts, public charges, taxes, and dues." This means businesses must accept cash for these specific purposes, but not necessarily for all transactions, including mortgage payments.

Are you arguing that a mortgage is not a debt??

No. I am saying in the US businesses have "freedom of contract" and can decide to accept cash or not. Check case law.

You cannot contract out this provision.

Suppose I'm a customer of your employer, and my contract says that the payments due are $1,000 per month by cheque or bank transfer only. I try sending $1,000 cash. Your employer rejects this payment and asks me to pay by cheque or bank transfer, per the terms of the contract. If I refuse, I'm in breach of contract and that gives your employer the right to foreclose on the lien against my house (subject to relevant local law and contract terms).

However, by breaching the contract, that also means I owe your employer a debt equal to the amount of the payment (or more, up to the entire amount, again depending on the exact terms and applicable law). If no money is owed, then your employer does not have the ability to foreclose. They can take me to court in a foreclosure action, but if I then plop down a stack of $100 notes of the correct size, then that absolves the debt. In reality, if this happened, it's probably more likely that the judge would direct me to pay the court clerk and have the clerk write a cheque or tell me to buy a cashier's cheque.

If they specifically want payment by bank transfer or cheque when they sue me, they're not suing for damages; they're suing for specific performance. That's not easy and it's usually quite hard to justify to the court why you want specific performance instead of just damages, especially since this would be a pretty facetious case to begin with. At the same time, I do think there is a good chance the judge will say "So the defendant offered the full amount that you want in cash and you turned them down? GTFO of here, case dismissed."

The act of offering legal tender as payment for a debt absolves the debt. If I offer your employer payment in cash, they cannot point to the contract as an excuse to refuse.

If you can cite case law to the contrary, I'm happy to admit you're right and revise my comments.

So no, businesses in the US do not have the "right to contract" out the legal tender nature of cash. It's just a small thing called "reality" that prevents the situation I describe from actually happening.

So is this conversation almost entirely pointless? Yes.