Damn, $11 a share. Sorry if you're still in.

DRS Your GME

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

Remember that there was a four for one share split, so if you're referencing prices before that, it equates to roughly $44 a share.

inb4 cope: Most of my shares are ~$12 pre split, so ~$3 per.

Damn, $44 a share. What was the peak? $480? Tough luck Jimmy investors

How about now?

Still up over 300%, and guess what? The AI boom is far from over.

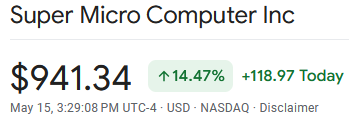

Enjoy the rollercoaster. I'll keep my stable GAINZ. SMCI +4% today fyi

How'd you do today champ?

never left, not leaving. will be buying more shares and putting them in my name

thanks for your concern though