Leaving aside the problem that you are choosing a date system depending on who is using the dating system and for what purpose, under that condition the most logical would be MM/DD/YYYY, which is truly terrible, so I'm going to politely ignore your argument.

PopularUsername

It's hydropower.

Lol the like to dislike ratio on this. Unsurprising for Lemmy.

He's a shitty person but any adoption is good adoption.

No wonder people advocate defederating from hexbear, you're basically spam. This is the second time you have responded to one of my posts, with the same line, and it's not a response to the post.

I usually don't interact with them, I just check out the sub from time to time. Some are actually pretty reasonable and have similar beliefs to Bitcoin maxis, calling out a lot of crypto scams, they just happen to also hate bitcoin on top of that 😂. I wouldn't go as far as calling it a troll sub.

greeting comrade

Weird, seems like the exact same concept but for social media, yet no one is here.

Thanks for clarifying about the other comment 😂 I honestly thought they said I would lose all my money if we were all on the same community, was genuinely confused.

The article is not about Bitcoin but it's the first thing I thought of while reading the article, smuggling gold is so 2010.

I just don't log in that often, still stuck on the Reddit juice. The paradox requires that society be maximally tolerant, if there is some level of intolerance and tolerance to authoritarian ideas, that's just regular society, happens in every country, and is not an example of a country that is exclusively tolerant of all positions.

I don't know of any country where someone can be openly pro fascist. I'm sure you could find some for me outside of western countries but that's not the point. That is, unless you are one of those people that calls Trump supporters literal fascist, in which case I will say: I think Trump is a used car salesman, an idiot, a massive problem for the United States, but definitely not a fascist coming to take over America. But if you believe that, then I can see why you believe people tolerate fascism but unfortunately that is a false perception and I'm not gotta be able to talk you out of it in an online post.

Most countries have laws or social norms that restrict Nazis, no one claims he be tolerant of Nazis so the theory does not apply to that case. I also don't see Nazis anywhere, there are some fringe groups, like there always has been, and more polarized politics, but you can't ban polarized politics, that would be a police state.

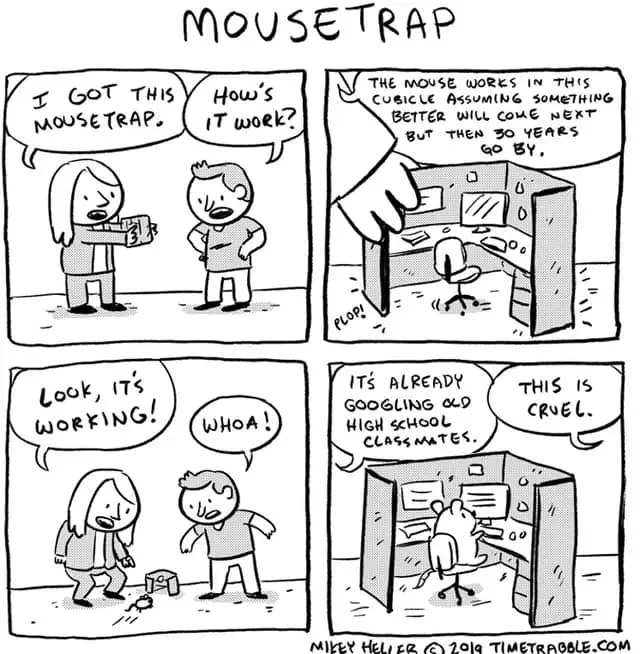

Any problem that is a prisoners dilemmas will produce this "paradox". But people don't describe prisoner's dilemmas as paradoxes because they resolve in some equilibrium. In a prisoner's dilemma, if one party always cooperates and does not cheat or punish, they will be eliminated by competition willing to do so. So in my example, if a society prioritizes niceness, then the nice will be taken advantage of, and there will no longer be nice people. But this doesn't actually happen, but it's the same logic.

So the first point was that depending on your files/archives and how you access it, year or month or day may be more relevant to the user, which is why I was saying it's dependent on the user, so I don't agree that a human centric solution is always going to say the year is less relevant.

And then if we are going to prioritize organizing the numbers in such a way as to save the eyes a millisecond of time, for standard usage month would be the orienting date since you need to make sure you are looking at today's month, and then day would be the next necessary date, and then you'd still need the year there, so you'd end up with Month Day Year. Putting Day first would be just as wrong as putting year first because it is irrelevant until you establish the month, it's too granular.